Tax Incentive Management

Developers face formidable hurdles in qualifying for and ensuring compliance with clean energy tax incentive requirements.

Constantly evolving and complex qualification requirements including ensuring that project EPC and contractors meet the correct prevailing wage and comply with the required percentage of apprenticeship further complicates matters. Qualifying for domestic content adders, energy community, and low income community adders require additional compliance documentation.

In addition, successful tax equity transactions require facilitating investor due diligence and managing indemnifications and insurance requirements - all intended to reduce recapture audit risk.

Empact Technologies maximizes the impact of clean energy project tax incentives with the industry’s premier IRA management platform.

With Empact Technologies, clean energy developers and investors can successfully:

Manage IRA Tax Equity Qualification and Compliance

Ensure Successful Tax Credit Sale

Protect Investors from Recapture Audit Risk

Developers traditionally hold EPCs liable for requirements via contract terms which is highly risky for IRA tax incentive compliance, as most EPC firms lack in-house expertise, systems and client visibility to guarantee projects are fully compliant

Empact Technologies combines a modern SaaS platform with professional services to deliver the renewable industry’s premier compliance management solution.

“I think your platform is perfect for what we are looking for. I do not see anything that could be improved.”

CEOUtility-scale solar and storage project developer

Our project compliance team acts as an “owners rep” and conducts weekly meetings with EPC and subcontractors to proactively manage and resolve payroll issues before they impact tax credits

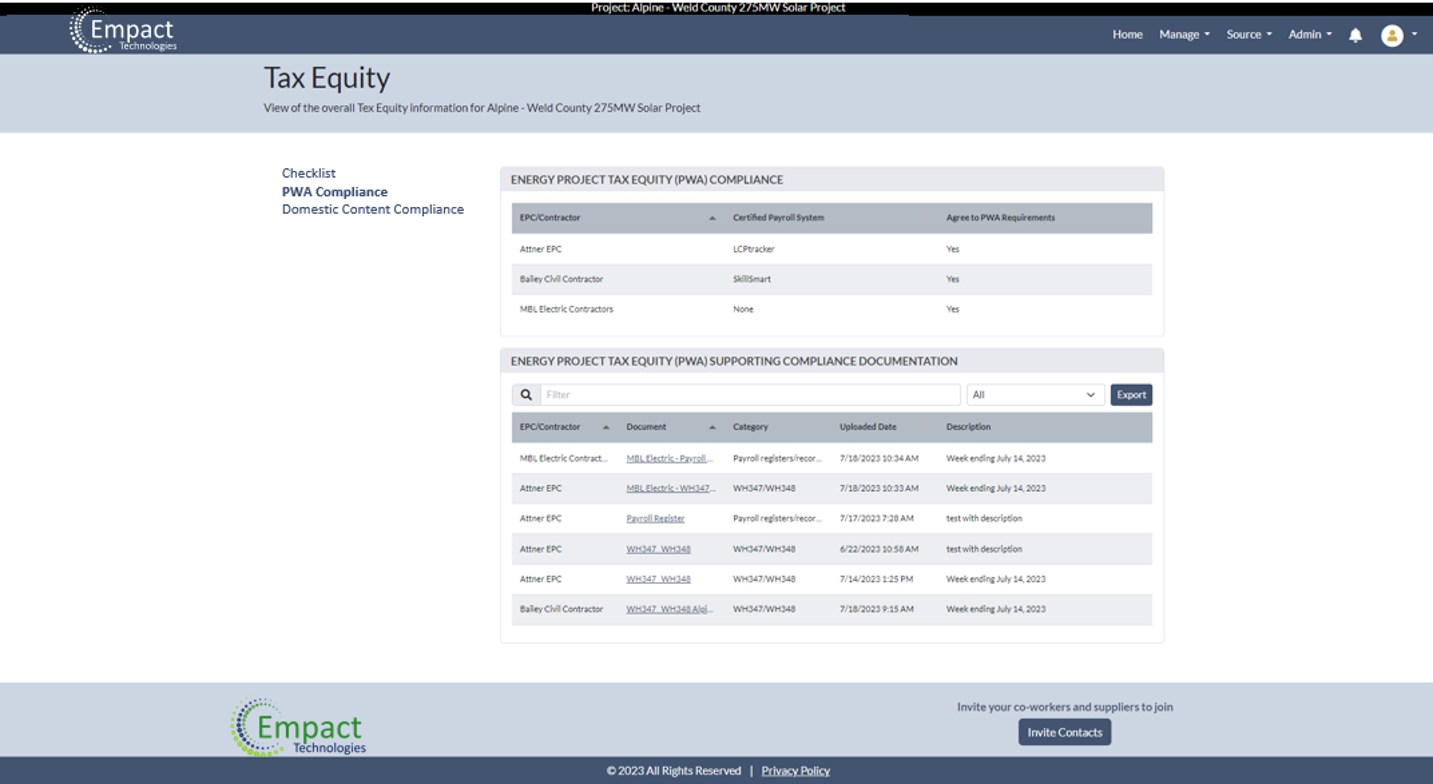

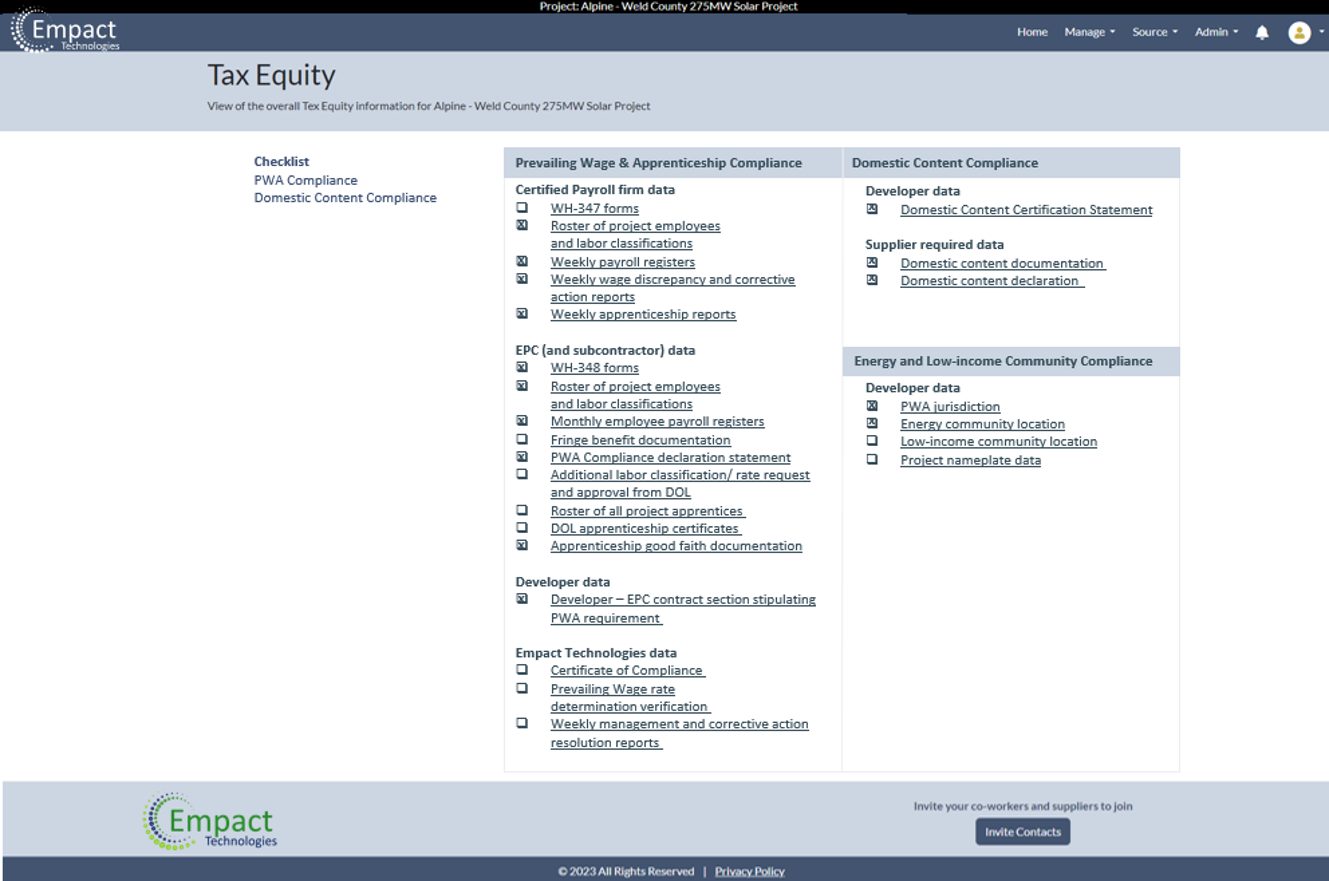

Prevailing Wage & Apprenticeship Compliance Management

The core of the IRA qualifying energy project tax credits is ensuring the project EPC and any subcontractors pay prevailing wage rates and use the required % of apprenticeship labor for the project construction and any additions or repairs during the 5- or 10-year tax period.

Empact Technologies captures and integrates required construction payroll information from project EPC certified payroll systems into our cross- project compliance management platform

We analyze the payroll data then work with the project EPC and subcontractors to proactively identify issues and manage resolution.

We create a data repository that enables qualification of the 30% clean energy project tax equity credit and support tax equity transactions

We maintain the data repository to protect tax equity investors from recapture audit risk

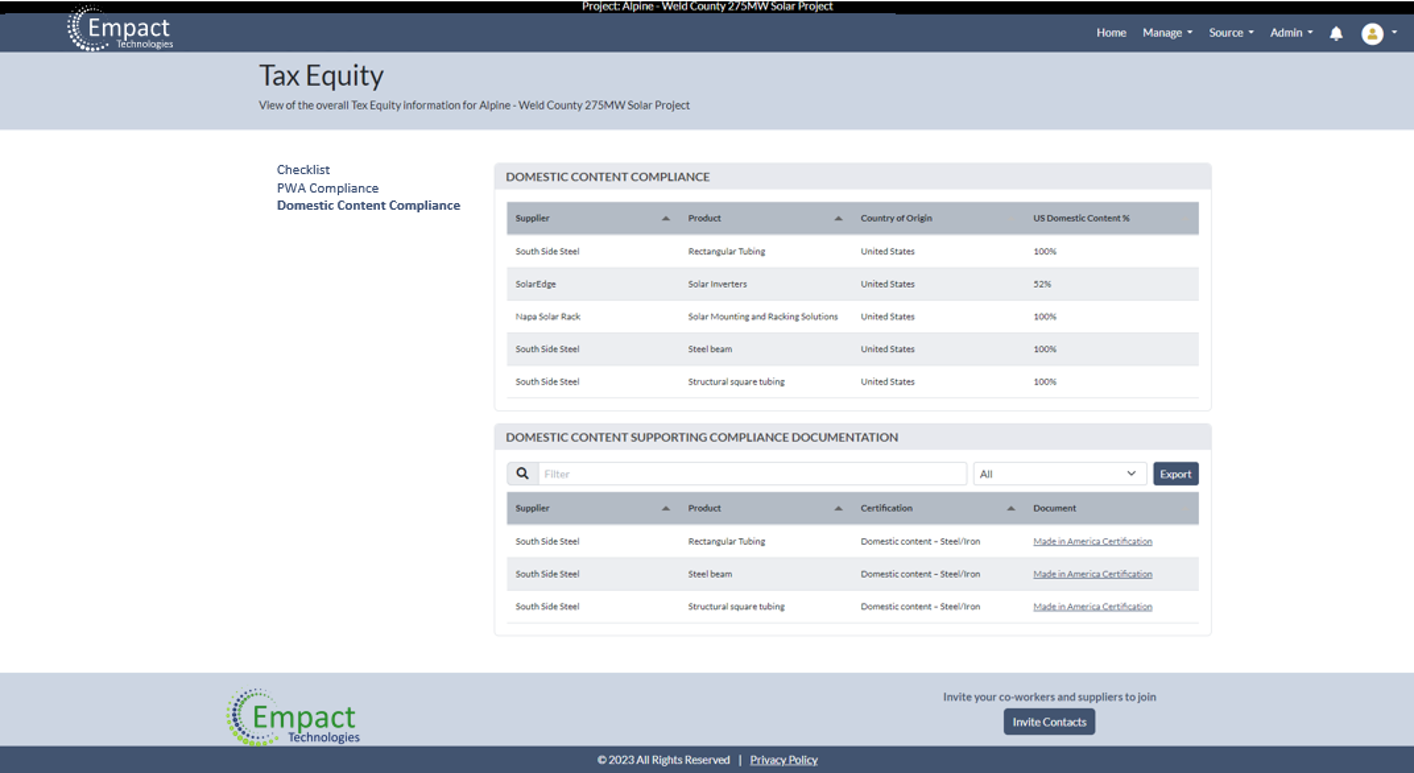

Domestic Content Compliance Management

The IRA included special additional tax equity credits if qualifying projects utilize products meet domestic content requirements. 100% of all steel and iron-based products must be Made in the US and the percentage of major manufactured products such as panels, batteries, inverters must also meet a certain % domestic content.

We enable developers to qualify for the domestic content tax equity credit adder. Our software platform includes a database of 1000's of suppliers including their products, manufacturing locations and more.

Our software captures supporting information from potential project suppliers including product domestic content %, certifications, manufacturing locations, Bill of Materials and more to ensure compliance with domestic content requirements.

We store the domestic content data in the same repository to support the 10% tax equity adder, support tax equity transactions and then maintain the data repository to protect tax equity investors from recapture audit risk.

Qualify for domestic content tax equity credit adder

Our software enable developers to qualify for the domestic content tax equity credit adder. Our platform includes a database of 1000's of suppliers including their products, manufacturing locations and more.

Capture supporting information

Empact Technologies captures supporting information from potential project suppliers including product domestic content %, certifications, manufacturing locations, Bill of Materials and more. We ensure compliance with domestic content requirements.

We handle everything

We store the domestic content data in the same repository to support the 10% tax equity adder, support tax equity transactions and then maintain the data repository to protect tax equity investors from recapture audit risk.

Ensure full IRA tax incentive qualification and compliance

Ensure project EPC and all subcontractors pay required prevailing wages and use the required apprenticeship labor % for project construction and repairs during the ITC or PTC period.

Capture required Steel & Iron supplier "Made in America" certifications and manage "Manufactured Product" domestic content % and supporting documentation to support IRS required Declaration Statement.

Document project energy community qualification including U.S.C. § 9601(39)(A) Brownfield, coal closure, or statistical area site, Nameplate capacity or Footprint qualifier, and other energy community supporting data.

For projects >5MW, capture low-income community qualification information (maps, etc.)

Reduce project insurance costs and buyer tax credit discounts by protecting investors from re-capture audit risk

Facilitate Tax Equity Transactions

Reduce tax credit investor due diligence time and required sponsor indemnifications and insurance with the industry's most comprehensive IRA tax equity compliance repository.

Protect Investors from Recapture Audit Risk

Project compliance data repository goes with tax credit sale to the investor to demonstrate "Reasonable Cause" and protect against IRS excessive credit transfer and recapture audit risk for full ITC or PTC tax period

“I was impressed by the software and how it thoroughly addresses the challenges of managing tax credits!”

Director - Project Development & OperationsC&I and Community scale solar and storage project